What Irs Form Is Used To File 401k Withdrawals

Millions of individuals took withdrawals from their IRAs, 401(k)s, pensions and other types of retirement accounts in 2014. When you do this, you need to know how to report these distributions on your tax return.

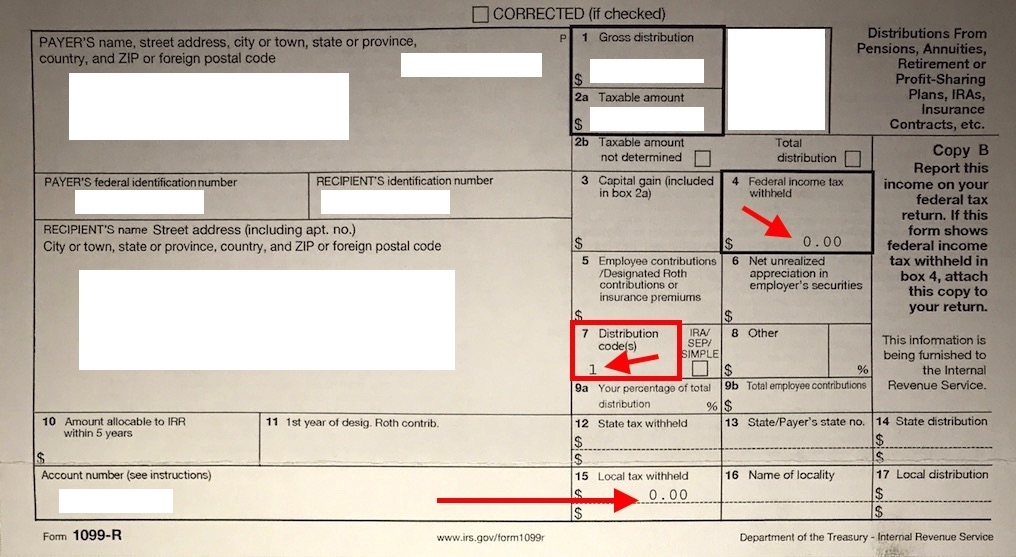

When to Use Tax Form 1099-R: Distributions From Pensions, Annuities, Retirement, etc. Variations of Form 1099-R include Form CSA 1099R, Form CSF 1099R and Form RRB-1099-R. Most public and private pension plans that are not part of the Civil Service system use the standard Form 1099-R. You should receive a copy of Form 1099-R, or some variation, if you received a distribution of $10 or more from your retirement plan. IRS Form 5329. A retirement account owner must begin taking required minimum distribution (RMD) amounts from his or her retirement account by the required beginning date and for every subsequent year. Failure to remove the RMD amount will result in the individual owing the IRS an excess-accumulation penalty.

The first thing to know is that if you took money out of your retirement accounts last year, you should have received a Form 1099 R. This form reports to the IRS the amount of your total withdrawals from a retirement account during the year. If you withdrew from several accounts, you should receive a Form 1099 R from each one.

The administrator of your retirement plan or custodian of your IRA sends the 1099, and it's not uncommon for these forms to have errors. So, pay careful attention to the information in several boxes to ensure that your 1099 is correct and that you report the information on your tax return correctly.

Here's the basic 1099 information you need to know:

Box 1 gross distribution: This includes the total of all withdrawals you took from a retirement plan or an IRA. Check your monthly account statements to ensure they agree with the 1099 R. If the 1099 amount is correct, report the amount in Box 1 on line 15a for IRA distributions and line 16a for distributions from pensions, 401(k)s and annuities of your Form 1040.

Crack means the action of removing the copy protection from commercial software. A crack is a program, set of instructions or patch used to remove copy protection from a piece of software or to unlock features from a demo or time-limited trial. Free keygens downloads.

Box 2a taxable amount: Usually this will be the same amount as what was reported in Box 1, but it could also be lower. For example, if you had contributed aftertax dollars into your 401(k) plan in the past, then when those after-tax contributions are withdrawn, they're tax-free and, therefore, would reduce the taxable amount of the total distribution. If you think you made aftertax contributions in the past and that the taxable amount is not reduced by that withdrawal amount, contact the firm that sent the 1099.

Here's a clue that this amount isn't correct: Look at box 2b. If the box for 'Taxable amount not determined' is checked, that means the form's provider didn't have enough information to correctly report any aftertax contributions.

Form 1040 401k Withdrawal

If this amount is correct, you can report the amount in Box 2a on line 15b for IRA distributions and line 16b for distributions from pensions, 401(k)s and annuities of your Form 1040.

Box 4 federal income tax withheld: This includes the amount of any federal income tax that was withheld from the withdrawals. For example, you may have elected to have 10 percent withheld from a withdrawal at the time you requested it. If you received a taxable withdrawal from a retirement plan such as a 401(k) plan, federal income taxes are typically withheld at a rate of 20 percent. Make sure to include the taxes that are reported in this box on your tax return on line 64, federal income tax withheld from Forms W-2 and 1099. Any state taxes withheld are included in box 12, and they should also be reported on your state tax return.

Box 7 distributions codes: More than 27 different codes could be included, which vary by the type of plan and distribution taken. The three most common codes are:

- Code 1 early distribution - no exception: This applies to individuals who take early withdrawals (before age 59 1/2) that are directly paid to themselves and not to a rollover IRA. Unless there is an exception, the taxable amount of the distribution is also subject to a 10 percent penalty tax on early withdrawals. To calculate and report this penalty tax on your tax return, you'll need to also file Form 5329, Additional Taxes on Retirement Plans and IRAs. Make sure to reduce the amount subject to this penalty tax by the amount of the nontaxable portion of your withdrawals (i.e. the aftertax contributions).

- Code 7 normal distribution: This applies to individuals who take normal distributions from retirement accounts after age 59 1/2. This code indicates to the IRS that this is not an early withdrawal. Therefore, no penalty tax applies.

- Code G direct rollover of a distribution: If you had your 401(k) directly rolled over to an IRA (when the plan transfers your entire taxable balance directly to your rollover IRA, without passing though your hands), this is the code you will want to see. It alerts the IRS that none of this distribution was taxable. Therefore, you also won't have to report any amount on line 16b of your tax return.

If your 1099 has any errors and you don't request a corrected form, the IRS may later on send a notice of additional tax due, requiring you to provide the information to explain what actually happened. It's a lot easier to request a corrected Form 1099 R now, than dealing with the IRS later. Trust me on that.

- CBS News AppOpen

- ChromeSafariContinue

- Non-Deductible IRA Contributions

- Roth IRA Conversions

- Recharacterizations

- Other Considerations

The tax Form 8606 has become increasingly important thanks to the popularity of the Roth IRA and the rollover eligibility of after-tax assets from qualified plans. Basically, you must file Form 8606 for every year you contribute after-tax amounts (non-deductible IRA contribution) to your Traditional IRA, and every year you receive a distribution from your IRA as long as you have after-tax amounts, including rollovers of after-tax amounts from qualified plans, in any of your traditional, SEP or SIMPLE IRAs. Here we'll look at this tax form and some of the rules surrounding it.

Non-Deductible (After-Tax) IRA Contributions

The taxability of your retirement-account distribution is usually determined by whether the assets are attributable to pretax or after-tax contributions. If your assets are in a qualified plan, then your plan administrator or other designated professional is assigned with the responsibility of keeping track of your pretax versus after-tax assets. For your IRAs, the responsibility rests with you.

Traditional IRA Contributions

If a taxpayer does not claim a deduction of his or her Traditional IRA contribution, it is usually either because he or she is not eligible, or simply prefers not to do so. An individual who is eligible for the deduction may decide not to claim it so that his or her future distributions of the amount are tax- and penalty-free. Regardless of the reason, the taxpayer must file IRS Form 8606 to notify the IRS that the contribution is non-deductible (counting as after-tax assets). To report the after-tax contribution, the individual must complete Part l of Form 8606.

Rollover of After-Tax Assets from Qualified Plans

One of the things that many people don't know about their IRAs is that they may rollover after-tax assets from their qualified plan accounts to their Traditional IRAs. According to IRS Publication 590: 'Form 8606 is not used for the year that you make a rollover from a qualified retirement plan to a traditional IRA and the rollover includes nontaxable amounts. In those situations, a Form 8606 is completed for the year you take a distribution from that IRA.' However, it may still be a good idea to complete the form for your records.

Distributions

What Irs Form Is Used To Make Payments

Form 8606 must usually be filed each year that distribution occurs from a Traditional, SEP or SIMPLE IRA if any of your Traditional or SEP IRAs hold after-tax amounts. Failure to file Form 8606 could result in the individual paying income tax and an early-distribution penalty on amounts that should be tax and penalty free. Distributions also are reported in part l of the form.

Distributions Are Pro-Rated

As we stated above, if you have after-tax amounts in your Traditional IRA, you must, when taking a distribution, determine how much of the distribution is attributable to the after-tax amount. The portion of the distribution that is non-taxable must be pro-rated with amounts that are taxable. For instance, if the individual contributed $2,000 in after-tax amounts and has a pretax balance of $8,000, a distribution of $5,000 would be pro-rated to include $1,000 after-tax and $4,000 in pretax assets. This pro-rata treatment must continue until all the after-tax amounts have been distributed.

IRAs Are Aggregated

To determine the portion of the distribution that is taxable, taxpayers must aggregate all their Traditional, SEP and SIMPLE IRAs balances. This requirement applies even if the after-tax contribution was made to only one IRA. The step-by-step instructions for Part l on the form will help the individual compute the taxable portion of the distribution. Win 10 activation key crack.

Roth IRA Conversions

An individual who converts his or her Traditional, SEP or SIMPLE IRA to a Roth IRA must be able to distinguish between the conversion assets and amounts representing regular Roth IRA contributions and earnings. This distinction is necessary for determining whether any portion of a Roth IRA distribution is subject to income tax and/or penalty. To properly account for these conversions amounts, the individual must complete Part ll on Form 8606.

Distributions from Roth IRAs

Section 3 is completed to report distributions from Roth IRAs. Completing this section allows an individual to determine whether any portion of his or her Roth IRA distribution is taxable and/or subject to the 10% early-distribution penalty.

Recharacterizations

An individual who recharacterizes a Roth conversion or an IRA contribution must attach a letter (statement) to his or her tax returnexplaining the recharacterization. In this letter you would, for instance, include how much is attributed to the contribution or conversion and the amount attributed to earnings or indicate if there was a loss on the amount. The information included in the statement is usually determined by whether the individual is recharacterizing from a traditional IRA to a Roth IRA or vice versa, or whether the individual is recharacterizing a Roth conversion. For examples of the information that should be included in the statement, see the instructions for Filing Form 8606.

Form 8606 is not filed if the entire contribution or conversion is recharacterized. However, if only part of the contribution or conversion is recharacterized, the individual must complete Part l of Form 8606.

Penalties

An individual who fails to file Form 8606 to report a non-deductible contribution will owe the IRS a $50 penalty. Additionally, if the non-deductible contribution amount is overstated on the form, a penalty of $100 will apply. In both cases, the penalty may be waived if the taxpayer can show reasonable cause for not complying with the requirements.

Other Considerations

Divorce

Generally, a transfer of IRA assets from one spouse to another is not taxable to either spouse if the transfer is in accordance with the divorce or legal separation agreement. If such a transfer results in a change in the ownership of the after-tax amounts, both spouses must file Form 8606 to show the after-tax amount owned by each. A letter explaining the change should be attached to each spouse's tax return.

What Irs Form Is Used For Self Employment

Inherited IRAs

Individuals who inherited IRAs that include after-tax amounts must also file Form 8606 to claim the non-taxable portion of the distribution. It is important to note that the after-tax amount in an inherited IRA cannot be attributed to a distribution of assets from a regular non-inherited IRA (i.e. an IRA that the beneficiary established with his or her own contributions.) This rule is one of the exceptions to the other rule that requires all Traditional IRA balances to be aggregated (explained above). For instance, assume that an individual has a Traditional IRA that he or she established and funded, and this IRA includes only pretax amounts. If this person inherits a Traditional IRA that includes after-tax amounts, his or her distributions from the inherited IRA would be pro-rated for determining the amounts that are attributable to after-tax assets. The balance of the beneficiary's own IRA would not be included in this computation.

The Bottom Line

Now you should have a good understanding of the importance of filing Form 8606. As we have demonstrated, filing this form could mean tax savings, while failure to file could result in paying the IRS tax and penalties on amounts that are actually a tax- and penalty-free. It is important to note that the information provided here is just a guideline and that each individual's circumstances may require some modification to the general filing requirements. If you are not sure whether you are required to file Form 8606, be sure to ask your tax advisor. And, for each year that you file this form, retain copies along with your tax return. These may prove helpful in the future for determining how your transactions were treated for tax purposes.